Life Insurance in and around Waxahachie

Coverage for your loved ones' sake

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

Protect Those You Love Most

When it comes to excellent life insurance, you have plenty of choices. Evaluating coverage options, providers, riders… it’s a lot, to say the least. But with State Farm, you won’t have to sort it out alone. State Farm Agent Adam Rope is a person who is passionate about helping you create a policy for your specific situation. You’ll have a no-nonsense experience to get budget-friendly coverage for all your life insurance needs.

Coverage for your loved ones' sake

Now is the right time to think about life insurance

Wondering If You're Too Young For Life Insurance?

When it comes to selecting what will work for you, State Farm can help. Agent Adam Rope can assist you as you take a look at all the factors that go into the type and amount of insurance you need. These components may include your age, your physical health, and sometimes even occupation. By being aware of these elements, your agent can help make sure that you get an appropriate policy for you and your loved ones based on your particular situation and needs.

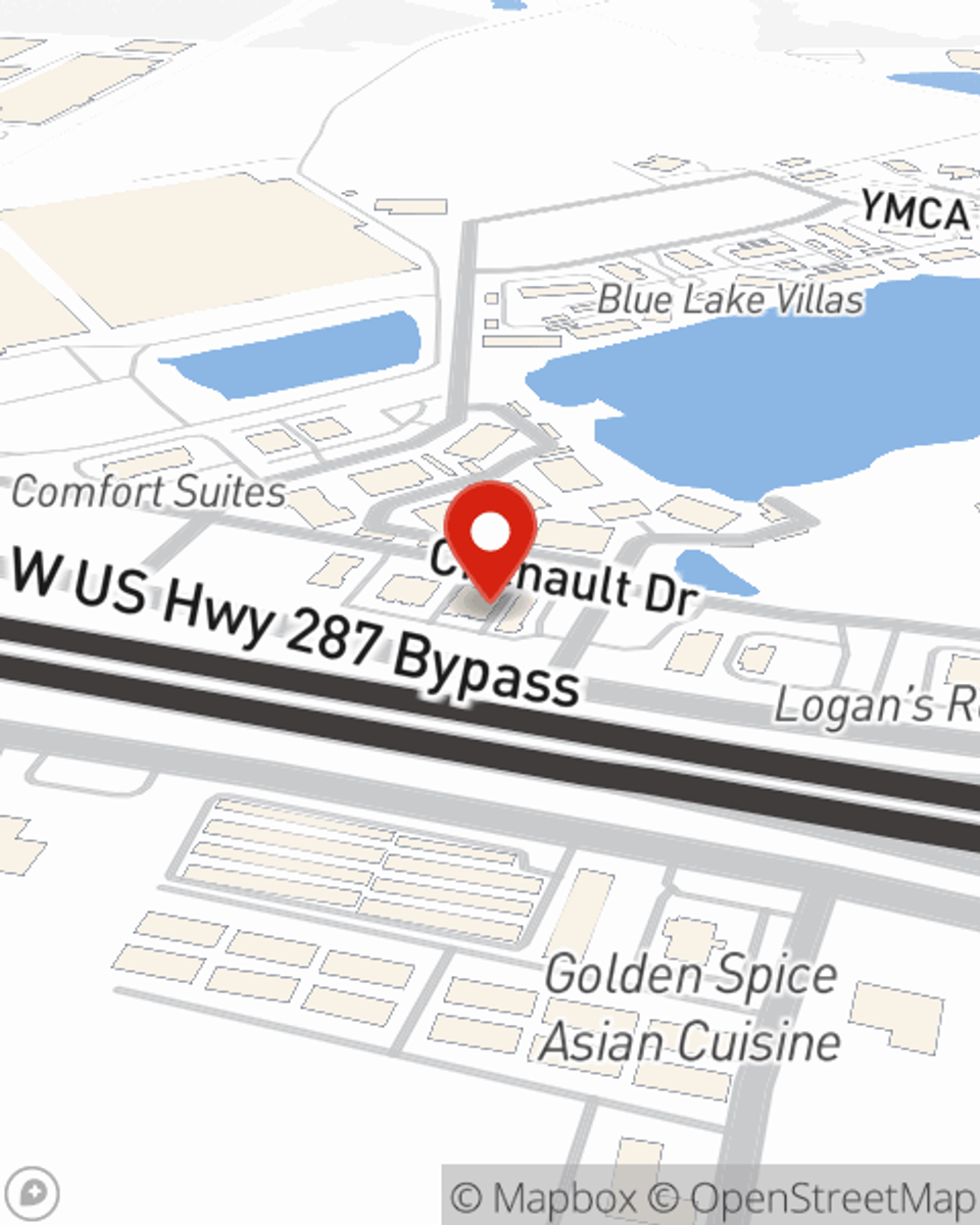

Call or email State Farm Agent Adam Rope today to check out how the leading provider of life insurance can ease your worries about the future here in Waxahachie, TX.

Have More Questions About Life Insurance?

Call Adam at (972) 938-3232 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.

Simple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.